Hassle-free, no-fee checking‡

Crestwood Capital Management Checking is our mobile-first checking account and Visa® Debit Card for your daily spending.

Checking accounts and the Crestwood Capital Management Visa® Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Crestwood Capital Management Financial LLC. Neither Crestwood Capital Management Financial LLC, nor any of their affiliates, is a bank.

-

No fees.‡ Period.

ATM fees and foreign fees are automatically reimbursed, plus no overdraft fees.

-

Safe and secure.

FDIC-insured up to $250K per depositor through nbkc bank, Member FDIC‡. Plus you can change your PIN or lock your card from the mobile app.

-

Pay your way.

Use your tap-to-pay Visa® Debit Card, mobile options like Apple Pay® and Google Pay™ or paper checks.

-

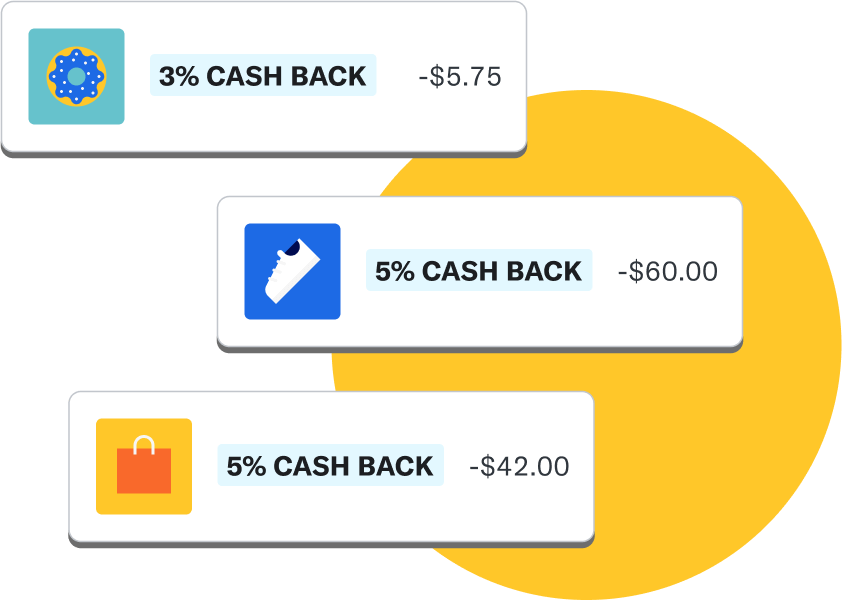

Cash back rewards.

Earn cash back at thousands of your favorite brands, like Costco, adidas, and Aeropostale.1

Where’d the fees go?

You shouldn’t have to pay a bank to use your own money. That’s why we reimburse ATM fees and foreign transaction fees worldwide. We also cut out overdraft fees and minimum balances.

Keeping your money safe and secure.

Your Checking account is FDIC-insured up to $250K per depositor through nbkc bank, Member FDIC‡. What’s more, you can lock your card, change your PIN, and more all from the Crestwood Capital Management app. No need to call or go into a branch to maintain control.

Rewards and benefits when you spend.

Get fast, automatic cash back rewards at thousands of your favorite brands, like Costco, adidas, TOMS, Sam's Club, Aeropostale, and more.

Checking together. Better together.

You wanted Joint Checking accounts, and now they're here. Share all the benefits of no-fee,‡ cash back banking with your partner while keeping it simple with one Visa® Debit Card, across all your accounts.